2023 payroll calculator

2022 Payroll Table Active Contracts Multi-Year Spending Positional Spending Financial Summary 2023 Free Agents. The minimum wage in Florida is adjusted annually on September 30 to reflect the inflation rate for the prior 12 months.

2

The Pay Rate Calculator is not a substitute for pay calculations in the Payroll Management System.

. In the event of a conflict between the information from the Pay Rate Calculator and. And Attendance System Direct Deposit Form Extra Service and Dual Employment Internal Revenue Services IRS Withholding Calculator Minimum wage rate. The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment to assisting businesses through COVID.

2025 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011. Fiscal Year 2023 beginning July 1 2022 is not a leap year. Clayton County Public Schools Payroll Department is a dedicated team committed to providing on-time and accurate pay to the systems.

October 4 2017 By Stephanie Leave a Comment Inc. To a maximum of 5000 business kilometres per car Deductions are. 630 000 divided by 150 then multiplied by 365 or 366 days.

If your EOD falls between January 1 and June 30 you will receive your increment in January 2023. If your EOD falls between July 1 and December 31 you will receive your increment in July 2022. If you employ for only 150 days in the year and the wages paid during that period is 630 000 your annualised wages total would be calculated as follows.

Try it save time and be compliant. Use this simplified payroll deductions calculator to help you determine your net paycheck. As a new employer I set out to create a Payroll Calculator but in the process learned that there were too many laws and regulations associated with payroll to risk using a spreadsheet for calculating payroll.

Growing Your Business Payroll Implications. In Fiscal Year 2023 in keeping with the usual practice contractual employees may receive an increment at the employing agencys discretion. Magazine reported one the fastest ways to grow your business is to buy another company.

But instead of integrating that into a general. CCPS Live Viewing List. PenSoft Payroll is the best value in payroll software.

This calculator allows you to calculate your estimated rate of payroll tax. Paylocity offers a suite of products to simplify payroll automate processes and manage compliance requirements. The Annual Tax Calculator is our most comprehensive UK payroll tax calculator with features for calculating salary PAYE Income Tax Employee National Insurance Employers National Insurance Dividends Company Pension Deductions and more.

Final CCPS 2022-23 Test Calendar All Schools. The calculator is updated for the UK 2022 tax year which covers the 1 st April 2022 to the 31 st March 2023. The SAWW is the average weekly wage paid in New York State during the previous calendar year as reported by the Commissioner of Labor to the.

All calculations will be based on an full years income at the rate specified. 1320 effective 12312021 Next of Kin Affidavit OSC AC934P. The Citys payroll system is based on the fiscal year covering the period July 1 through June 30.

QuickBooks Payroll Software helps small businesses to run and manage payroll seamlessly and hassle-free. We also offer a 2020 version. I did create a Paycheck Calculator to estimate tax withholdings and calculate net take home pay.

The rate is based on annualised wages. Cash Payrolls Luxury Tax Payrolls. Mileage calculation provided by the Australia Taxation Office - 78 cents per kilometre from 1 July 2022 for the 2022-2023 income year.

The payroll tax rate reverted to 545 on 1 July 2022. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. 2022 Payroll Deduction Calculator 2023 Payroll Deduction Calculator.

Cloud-based payroll and human resources management specialist Paylocity NASDAQ. PCTY has lost ground in recent sessions although its still far from closing the gap from a price jump following its earnings report. Statewide Average Weekly Wage Paid Family Leave deductions and benefits are based on the New York Statewide Average Weekly Wage SAWW.

Employment verifications may be sent to the Payroll Office 878-4124. If you specify you are earning 2000 per mth the calculator will provide a breakdown of earnings based on a full years salary of 24000 or 2000 x 12. These figures derive from a players payroll salary which includes the combination of a base salary incentives any signing bonus proration.

Florida Hourly Paycheck and Payroll Calculator. An updated look at the Boston Red Sox 2023 payroll table including base pay bonuses options tax allocations. Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year.

This calculator uses the redesigned W-4 created to comply with the elimination of exemptions in the Tax Cuts and Jobs Act TCJA.

1

1

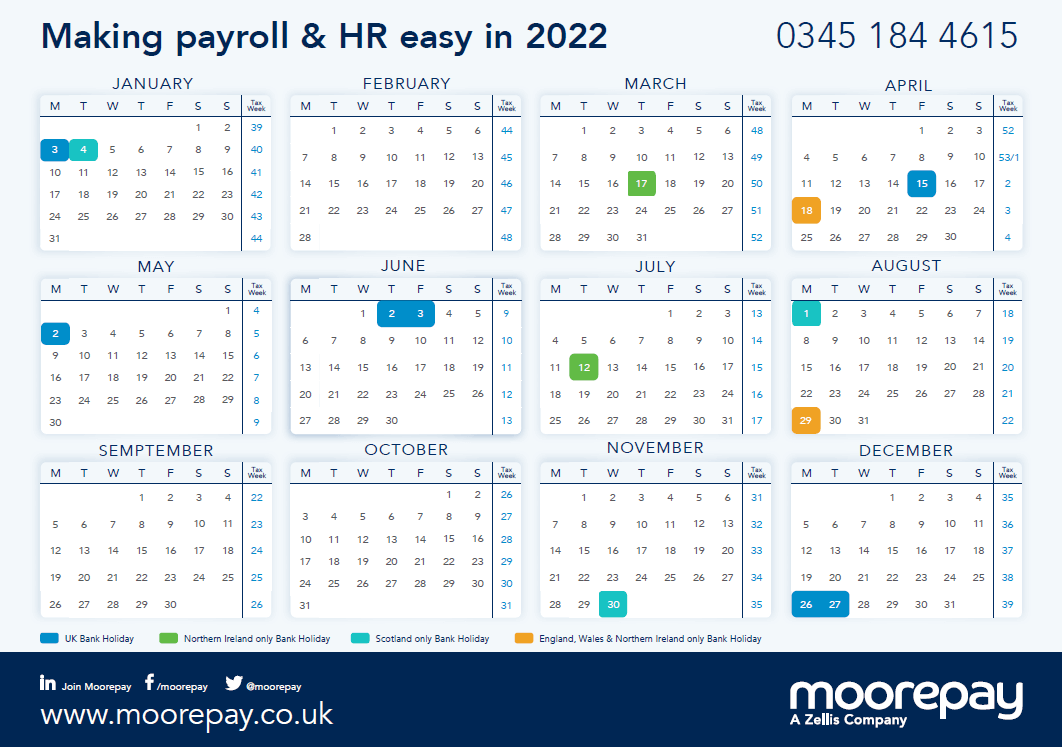

Calendar 2022 Moorepay

2

What Does 2022 23 Look Like For Payroll

Tax Brackets 2022 Uk

Off Payroll Ir35 Calculator Results

Wall Planner 2022 23 Moorepay

Bi Weekly Schedule Template Luxury 7 Biweekly Payroll Calendar 2015 Template Payroll Calendar Payroll Calendar Template

1

2

Grade Book Templates 13 Free Printable Doc Pdf Xlx Grade Book Grade Book Template Templates

What S In Your Pantry Pantry Inventory Printable Checklist Pantry Inventory Pantry Inventory Printable Pantry Inventory Sheet

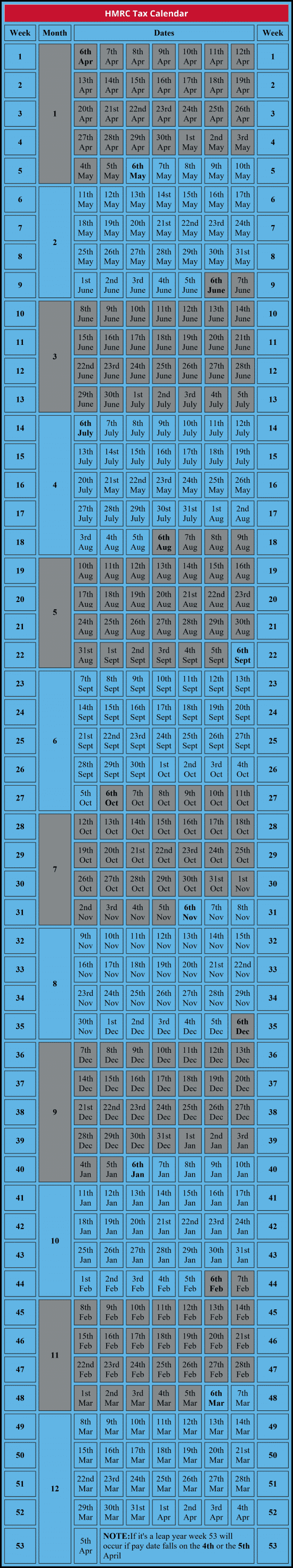

Pay Dates And The Hmrc Tax Calendar Iris

2

Supremecapitalgroup On Twitter Personal Financial Management Financial Institutions Financial Management

Business Operating Budget Template Operating Budget Template Operating Budget Template What To Know About I Budget Template Free Budget Template Budgeting